PVOIL EXPECTS TO COMPLETE 2021 PROFIT TARGET OF 400 BILLION VND

23.04.2021

In 2021, if the market condition are favorable, PVOIL completes the profit goal for the year, the corportion will consider the plan of dividend payment, Chairman of the Board of Management Cao Hoai Duong shared the information during a recent meeting with major shareholders, investment funds, securities companies organized ahead of the 2021 Annual General Meeting of Shareholders, which will take place at 08:30 on April 27, 2021. This will be an online meeting.

In 2020, the double impacts of the COVID-19 pandemic and the decline in oil prices seriously affected PVOIL’s business activities. The corporation had strategy to manage inventory, petroleum source to minimize damage from cutting price for inventories.

The retail channel maintained good output volume. Sales through PVOIL Easy grew strongly despite the pandemic. When pandemic outbreak was reported, PVOIL quickly built scenarios to face tb crisis and cost reduction options corresponding to each scenario. With the policy of “tightening austerity”, PVOIL minimized costs and losses in unfavorable business conditions. Among PVOIL’s subsidiaries, besides those with losses, there were still business units reporting profits.

In 2021, PVOIL proposed a consolidated pre-tax profit target of 400 billion VND. In the first three months of the year, PVOIL made good use of market opportunities to maximize profits. Although the enterprise did not complete the quarterly sale target due to the resurgence of COVID-19 pandemic, the consolidated pre-tax profit was reported at 178 billion VND, beating target by 78%, contributing 45% of the annual plan. PVOIL opened 12 new petroleum stations, bringing the total number of stations in the whole system to 602. PVOIL continued to promote its advantage of being the first and only petroleum retailer applying a non-cash payment solution by QR code scanning at all petroleum stations nationwide. The PVOIL Easy program reached an average output of more than 6,200 cubic meters a month, equivalent to the output of 55 petroleum stations. The output grew 14% over the same period of 2020.

The recovery of PVOIL’s stock price reduced pressure of suffering losses of shareholders and investors. At the current stock price and the development strategy of corporation, PVOIL President & CEO Doan Van Nhuom said it is possible to hold OIL shares for long-term benefits.

From the asset value perspective, PVOIL owns a significant land bank associated with 29 large and small petroleum storages and more than 600 petroleum stations nationwide. The number of petroleum stations is expected to increase by 30-50 stores a year.

The value of the asset keeps expanding steadily every year. When PVOIL reassessed its assets for its subsidiary PVOIL Mien Trung for equitization process, it found that the enterprise value was 3.3 times higher than 10 years ago.

PVOIL’s leaders affirmed that the retail channel development is an important and consistent strategy of the business. PVOIL steadfastly aims to promote the petroleum retail system development in order to increase the efficiency of production and business in a sustainable way. The strategy also create assets with high value to facilitate transition to other business areas as well as diversify business methods when needed. PVOIL aims to have 800 petroleum stations by 2025.

Regarding the equitization process, PVOIL is monitoring and actively coordinating with relevant authorities to deal with problems and difficulties to speed up this process. Currently, the settlement of equitization of PVOIL is presided over by the Ministry of Industry and Trade.

In addition, major shareholders and investors pay much attention to several issues related to the current business as well as the long-term strategies of PVOIL including the wwholesale and retail strategy, the impact of the revised Decree No.83 on petroleum trading on PVOIL’s operations, the impact of the State's policies in fighting against petroleum smuggling, divestment at PETEC, State divestment plan at PVOIL, the impact of the energy conversion trend and the development trend of electric cars on PVOIL’s business activities…

PVOIL’s Board of Directors also affirmed that the corporation closely monitors the conversion trend from fossil energy to green energy, the development trend of electric cars in the world and in Vietnam to proactively adapt to limit danger and utilize the opportunity to ensure the long-term and sustainable development of PVOIL.

Closing the meeting, PVOIL Chairman Cao Hoai Duong expressed gratitude to shareholders and investors for their interest and support to PVOIL’s production and business activities in the past years, especially 2020, when the economy was badly hit by the COVID-19 pandemic. Along with the business results achieved in the first quarter of 2021 and favorable market prospects in 2021, PVOIL aims to achieve the full year profit plan and consider the dividend plan for 2021.

Mr. Cao Hoai Duong - Chairman of the Board of Management (right) and PVOIL President & CEO Doan Van Nhuom (left) preside the meeting.

PVOIL leaders meet with major shareholders and investors

Investor’s representative ask questions during the meeting

Overview of the meeting

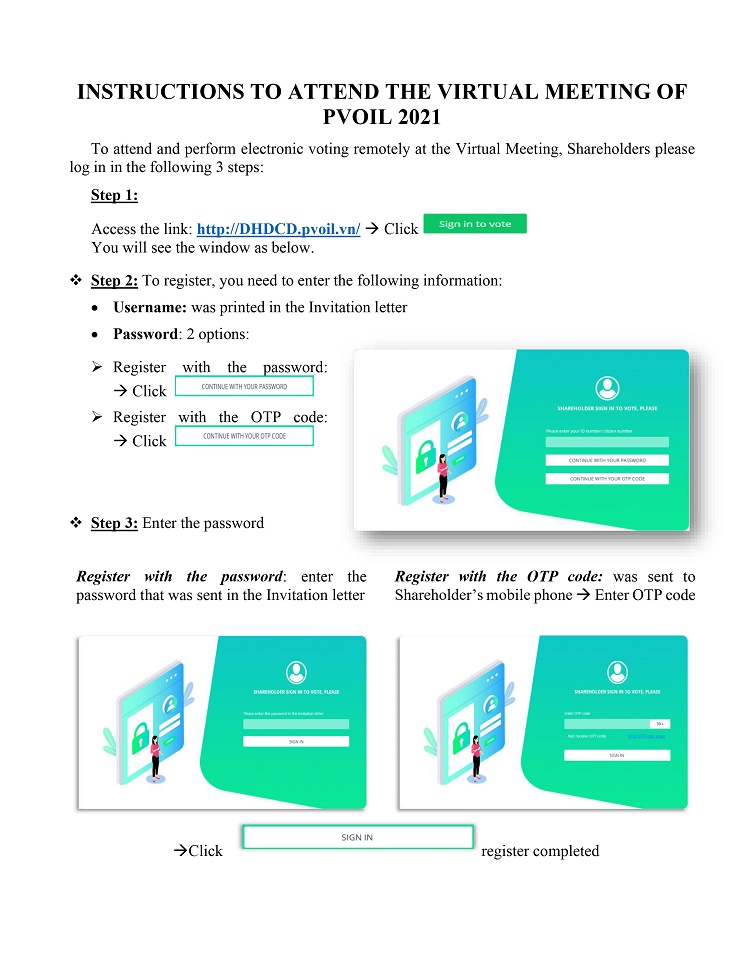

PVOIL will hold the 2021 Annual General Meeting of Shareholders at 08:30 on April 27, 2021. This will be an online meeting. Shareholders are invited to log in to attend the meeting according to the instructions below:

PVOIL News

PVOIL News