PVOIL Annual General Meeting of Shareholders 2022: dividend in 2021 in cash at the rate of 3.5% of charter capital

28.04.2022

On April 28, 2022, PetroVietnam Oil Corporation (PVOIL, UPCoM: OIL) held 2022 Annual General Meeting of Shareholders in the online form. At the meeting, the corporation’s Board members and shareholders evaluated the operation results in 2021, plan for 2022, and other issues.

The meeting was attended by shareholders representing 946,718,659 shares, accounting for 91.54% of the total number of voting shares of PVOIL.

Representing major shareholder, the Vietnam Oil & Gas Group (Petrovietnam) was Mr. Le Xuan Huyen, Deputy General Director of the Group. Mr. Vo Thai Hoa, Deputy General Director of Deloitte Vietnam, which is the independent auditor of the parent company, attended the meeting.

On the side of PVOIL, Mr. Cao Hoai Duong, Chairman of the Board of Management of the Corporation, PVOIL President & CEO Doan Van Nhuom together with members of the Board of Management, Board of Directors, Board of Supervisors, Chief Accountant, Heads of Unions, Heads of Divisions, Offices of Corporations attended the meeting.

Reporting to shareholders, PVOIL leaders said in 2021, the corporation underwent a year of volatile petroleum markets and the Covid-19 pandemic that has greatly affected all aspects of the economy.

Thanks to flexible and effective solutions, PVOIL successfully completed the business targets assigned by shareholders, with outstanding growth in profit. Petroleum output of the system reached 3,132 thousand cubic meters, completing 99.4% of the year plan, up 7% compared to 2020.

Total revenue of the year reached 58,299 billion VND, completing 105% of the whole-year plan, 15% higher than the same period. Consolidated pre-tax profit reached 928 billion VND, 2.3 times higher than the assigned plan. PVOIL continued to promote its effectiveness in diversifying and modernizing business activities, enhancing its position and reputation in the market.

In 2022, the pandemic situation remains complicated, the Russia-Ukraine conflict entails many potential consequences and risks. Recognizing the opportunities and challenges of the market, PVOIL sets a plan for 2022 with total consolidated revenue of 45,000 billion VND, and a consolidated pre-tax profit of 500 billion VND.

At the meeting, PVOIL updated the business results for the first quarter of 2022 with the total petroleum consumption volume reaching a record of 875,000 cubic meters, reaching 27.8% of the whole-year plan. Consolidated revenue was estimated at 23,288 billion VND, reaching 52% of the year plan. Consolidated pre-tax profit was estimated at 353 billion VND, achieving 71% of the year plan and increasing by 71% over the same period in the first quarter of 2021.

After listening to the reports, shareholders asked several questions such as: Impact of Decree 95, the development of electric vehicles on the operation of PVOIL; Factors that help PVOIL achieve positive results in the context of difficult and volatile markets in 2021 and the first quarter of 2022; Performance of business cooperation contract between PVOIL and PV GAS; Cooperation with Vietjet in fuel business; Plan to develop petrol stations, non-petroleum services; Application of digital transformation in operations; Dividends in 2021 and plan for dividends in 2022; Plan to change the exchange… and some issues related to restructuring.

Explaining the issues before shareholders, the Board of Management of PVOIL specifically and satisfactorily answered questions and received a high consensus of shareholders.

The leaders of PVOIL said that the corporation plans to move the listing of OIL shares from UPCoM to HoSE when all the conditions for the exchange are met. PVOIL and Vietjet currently have good cooperation in trade and use of each other's products and services and are continuing to implement cooperation contents in the business of Jet A1 gasoline.

Regarding dividends, PVOIL will pay dividends in 2021 to shareholders as soon as possible. If the operation in 2022 is favorable, the dividend is expected to be equal to or higher than in 2021.

PVOIL President & CEO Doan Van Nhuom said that in 2021 and the first quarter of 2022, PVOIL made good use of market opportunities and maintains reasonable inventories to achieve positive business results. PVOIL actively planned to source domestic and imported goods to make up for the shortage of sources from Nghi Son Refinery and Petrochemicals and requested the refinery to announce the plan to operate the plant soon. If the situation is as stable as now, PVOIL expects output to increase by 3-4% this year, in favorable circumstances, the output can increase by 5-7%.

The energy transition is an inevitable trend, in which the strong development of electric vehicles directly affects traditional petroleum production and business activities. PVOIL always closely monitors the market to make the right investment step at the right time, turning challenges into opportunities, said Chairman of the BOM of PVOIL Cao Hoai Duong.

Currently, PVOIL has a cooperation program with partners to convert a number of petroleum stations into diversified service stores, having both a petroleum pump station and an electric vehicle charging station to serve customers.

In addition, PVOIL applied digital transformation in operations, bringing high efficiency. It took the leading position in implementing cashless petroleum payment through the PVOIL Easy program and expands links with the largest electronic payment applications in Vietnam. On that basis, PVOIL has also developed software for wholesale customers (PVOIL B2B) to create more convenience for customers. In the near future, PVOIL will deploy technology applications for individual customers, modernize petrol pump poles, Chairman Cao Hoai Duong added.

Mr. Le Xuan Huyen, representative of PetroVietnam, PVOIL’s major shareholder, highly appreciated the business results achieved by PVOIL in 2021, an extremely difficult year due to the Covid-19 pandemic.

In addition, PVOIL has actively fulfilled its offtake obligation, supporting domestic oil refineries to avoid tank-top situation when market consumption plummeted due to widespread and prolonged social distancing, he said.

In 2022, recognizing that the market has many potential difficulties and uncertainties, Mr. Le Xuan Huyen hopes that with the experience of overcoming difficulties in the past years, PVOIL will continue to successfully complete the 2022 plan, bringing benefits to the companies. shareholders and actively contribute to stabilizing the national energy market.

After discussing and answering questions from shareholders, the General Meeting of Shareholders approved the contents presented at the meeting (4 reports and 5 submissions) with a high consensus rate of over 99%. In which, shareholders approved the profit distribution plan with the 2021 cash dividend at the rate of 3.5% of charter capital.

Speaking to close the meeting, Mr. Cao Hoai Duong thanked shareholders for participating in the meeting and always supporting, supporting and accompanying PVOIL. PVOIL will strive to complete and exceed the 2022 plan assigned by the General Meeting of Shareholders.

The Executive Board of the AGM of Shareholders

Mr. Le Xuan Huyen – Deputy General Director of PetroVietnam attends the General Meeting of Shareholders in the online form

Shareholders ask questions to the Executive Board via the online system

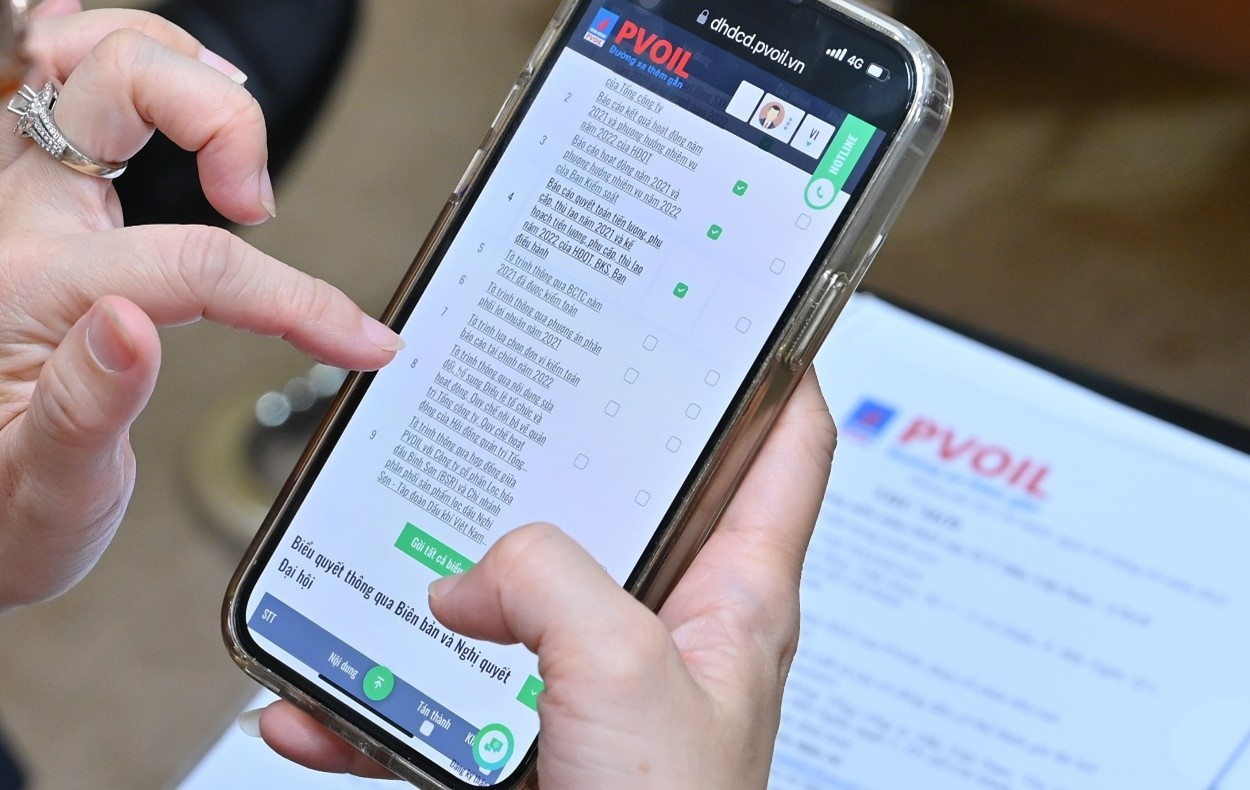

Shareholders vote on the contents via the online system

PVOIL News.